In financial markets, it is crucial to make well-informed decisions that align with your investment strategy. Investing in DeFi involves similar strategic decisions and considerations as traditional finance, including opportunity cost. Opportunity cost decisions in DeFi may include choosing one lending or decentralized exchange protocol over another, opting for Liquid Staking Derivatives (LSD), or selecting a different investment opportunity altogether. The opportunity costs can depend on various factors such as your risk tolerance, comfort level with the protocol, and data analysis. Amberdata's comprehensive decentralized finance data enables users to make informed decisions to generate alpha and mitigate risk by providing quantitative data to determine opportunity costs for transactions and protocols.

Opportunity Cost in DeFi Example

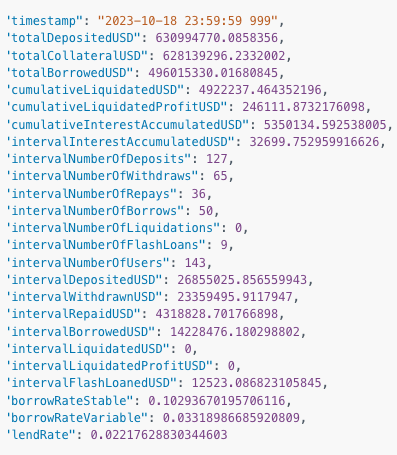

A user is trying to decide whether adding ETH to Lido or the WETH pool on Aave v3 will generate a better return on investment. Using Amberdata’s asset metrics insights, they queried the current lending rate for a pool on Aave v3. Below is the response of the asset metrics query:

Running this query shows that the lending rate for Aave v3 on October 18th, 2023 is around 2.2%, meaning that a liquidity provider in this pool will make 2.2% APR on their investment. Historical lending rates are also crucial to analyzing opportunity costs, and Amberdata provides a comprehensive history with customizable date ranges from a protocol’s inception.

But what return on investment can a user expect from adding ETH to a Liquid Staking Derivatives (LSD) like Lido? See the current APR of Lido (along with the Beacon chain) by using this Jupyter Notebook. On October 18, 2023, adding ETH to Lido would give a user a return of about 3.4%.

So, what is the opportunity cost between providing liquidity on Aave v3 and staking on Lido? Without proper data analysis, a user would be missing 1.2% in ROI by choosing Aave. This amount may seem small but could result in a significant opportunity cost depending on the size of the investment. Quantitative data is necessary to determine the opportunity costs for a transaction or protocol. With Amberdata’s comprehensive decentralized finance data, users make informed decisions, generate risk models, and mitigate risk.