The Decentralized Finance Primer (DeFi)

The DeFi Primer provides an introduction to DeFi and explores five of the key protocols of the DeFi space – trading (DEX), borrowing/lending, staking, insurance, and asset management.

What is DeFi?

Decentralized Finance (DeFi) is an umbrella term for a global financial system operating on public blockchains. The abbreviation sounds like “DE-fy”, which is intentional.

DeFi was coined in 2018 by a group of entrepreneurs and Ethereum developers who wanted to create an alternative to traditional finance. While there is no single inventor, DeFi applications were first developed for the Ethereum blockchain. DeFi uses technology to create a peer-to-peer marketplace to facilitate transactions, replacing the middleman (e.g., banks or brokerage firms).

Smart contracts are the critical innovation that drives DeFi. These pieces of code implement complex transactions between individuals and run automatically on blockchains when predetermined conditions are met. With smart contracts, peer-topeer transactions are possible without requiring a centralized entity to manage and approve them. Financial primitives like trading and lending are implemented in DeFi protocols as decentralized applications (dApps) that rely on smart contracts to settle transactions.

DeFi Total Value Locked (TVL) increased from a mere $601 million at the start of 2020 to $239 billion near it’s high in 2022. While the current downturn in all risk on assets has brought the DeFi TVL down considerably as of Q3 2022, with institutional participation still in the early stages, TVL is likely to increase dramatically in the coming years.

As one of the most exciting corners of the digital asset class, DeFi is redefining how financial products and services are consumed. It is completely changing how financial primitives are structured and traded, allowing new financial products to be built and deployed with instant global reach. Here are some of the transformational aspects of DeFi in comparison with traditional financial services:

Compostability

ABecause DeFi apps are open source, they can be used by any developer to innovate and create new applications. DeFi apps are like “money legos” that can be snapped together to build new financial products and services.

Immediate Global Reach

Anyone with a network connection can build or access DeFi applications as soon as they are deployed on the blockchain. What the internet has done for commerce, DeFi is doing for finance.

Reduced Cost

When compared with traditional finance, DeFi is lower cost because it removes middlemen like banks and brokerages from financial transactions.

Fast Transactions

Because DeFi removes the middleman and is built on smart contracts running on blockchain infrastructure, payment settlement times, particularly for large transactions, can go from days to minutes. Even complex transactions that must navigate multiple regulatory environments (e.g., international transfers) could be automated by coding the appropriate logic into a smart contract.

Automated Execution

Once deployed on-chain, smart contracts execute without any human intervention when the associated pre-conditions are met.

Because of the potential operational improvements that DeFi adoption could bring to the financial services sector, the existing TVL is just the tip of the proverbial iceberg. In 2021, the global financial services market was estimated to be worth more than $23.3 trillion, meaning that at present, DeFi accounts for less than ½ % of the total. An increase to just 5% would see over a trillion dollars flow into the space.

The DeFi Infrastructure

In traditional finance, there are two core components that allow the current system to work: infrastructure, and currency. In the traditional system, banks and financial institutions provide the infrastructure. Fiat money, like the US dollar, acts as the currency. DeFi must replace these components in order to offer a full range of financial services.

Blockchains, Smart Contracts and Apps

Blockchains that support smart contracts are the basic infrastructure of the DeFi ecosystem. Ethereum was the first blockchain to support smart contracts and much of DeFi still runs there. As mentioned previously, smart contracts are pieces of code that implement agreements between participants and execute only when predefined conditions are fulfilled. The terms of the agreement, usually a financial transaction, are written into the code of the smart contract. This creates a set of rules that establish how that financial transaction will work - programmatically, and autonomous of any centralized institution.

Decentralized applications (dApps), which are built on smart contracts, replicate traditional financial services functions such as trading, borrowing, and lending. They are the building blocks of the new decentralized financial system. Open-source protocols are being developed alongside public blockchains, forming a framework for decentralized finance to operate on. As mentioned previously, one of the unique features of DeFi is that all of these dApps can be thought of as money legos. These money legos provide composability that allows developers to create, modify, mix and match, link, or build on top of existing DeFi protocols without permission, delivering one of the most compelling features of DeFi.

DeFi data is key to gaining visibility into lending protocols and decentralized exchanges (DEX). With Amberdata, you can effectively manage your DeFi portfolio. Identify opportunities and quantify risk by viewing TVL, liquidity events, flows in and out of protocols, active users, and transactions within and across protocols and pools.

Crypto Wallets

Crypto wallets are another infrastructure component, providing the gateway to DeFi. Users participate in DeFi dApps through a wallet, which allows self-custody of their assets.

Crypto wallets manage the private keys that allow a participant to access their digital assets. The wallet also allows the secure transfer of digital assets. There are different types of wallets available, including mobile apps, exchange wallets (hot wallets), and wallets that look like USB sticks (cold wallets). Although there is some variation, most function in a similar way by storing private key pairings that allow you to sync your wallet across multiple devices in order to connect to dApps and send and receive digital assets. Crypto wallets hold the public and private key information needed to carry out DeFi transactions while actual digital assets are stored on the blockchain.

Oracles

Oracles are another important infrastructure component, providing the link between off-chain and on-chain data. They serve as bridges between DeFi dApps and the outside world. For many contractual agreements, it is vital to have relevant information from the outside world, however smart contracts cannot access off-chain data on their own.

Amberdata provides pricing feeds and other off-chain data to oracles. A DeFi protocol that needs to show accurate cryptocurrency pricing across both DEX (on-chain) and CEX (centralized exchanges with off-chain data) can do this by connecting with an oracle.

Oracles broaden the scope in which smart contracts operate. Without blockchain oracles, smart contracts would have very limited use as they would only have access to data from within their networks. The data transmitted by oracles comes in many forms: crypto price information, the successful completion of a payment, or even the temperature measured by a sensor.

There is over $100 billion in TVS (total value secured) across all third party oracles and first party oracle technology providers, bringing off-chain data to nearly 300 protocols.

There are two types of oracles: third-party and first party. Third-party oracles connect to external data providers and publish their data to the blockchain. They are fundamentally middlemen that often aggregate multiple data feeds. Chainlink operates the leading third-party oracle network. In contrast, first-party oracle data is provided directly by a known external API provider. First-party oracles provide DeFi developers and projects with transparent access to off-chain data cost-effectively, and with reduced risk. API providers deliver off-chain data in partnership with first-party oracle technology providers, including API3, Pyth Network, and Flux Protocol.

In 2021, the total value locked (TVL) inside the DeFi industry increased from $18.7B to $247.8B, a 1,222% increase.

DeFi Coins

DeFi coins are the currency of DeFi. The top DeFi coins are a mix of blockchain native coins, stablecoins and protocol-specific tokens. ETH, AVAX and MATIC are examples of blockchain native coins. Since the majority of DeFi activity occurs on Ethereum, some view holding ETH as a proxy to DeFi exposure. Avalanche’s AVAX and Polygon’s MATIC are increasingly popular DeFi coins with a combined market cap of over $10 billion. DAI is an example of a decentralized stablecoin pegged against the US dollar. 1 DAI is equal in value to $1 USD. DAI’s value is backed by cryptocurrency collateral, rather than US dollar reserves. UNI is an example of a protocol-specific coin and is the native coin of the Uniswap protocol – important because nearly half of the DeFi market is capitalized on Uniswap.

The market for stablecoins experienced incredible growth in 2021, with the supply for dollar-backed cryptocurrencies surging by 388%.

The DeFi Landscape

DeFi is comprised of a wide variety of protocols, and more are added all the time as the space evolves. Some of the key protocols are listed below and discussed in the following sections:

- Trading

- Borrowing/Lending

- Staking

- Insurance

- Asset Management

Trading

The largest DEX is Uniswap. It was created by Hayden Adams, a mechanical engineer from New York. The idea came from posts written by Ethereum’s founder about developing an automated market maker and decentralized exchange. As of May 2022, Uniswap facilitates over $3 billion in daily trading volume.

In DeFi, the large-scale trading of crypto assets occurs on decentralized exchanges (DEXs). A DEX does this entirely through automated algorithms instead of the conventional approach of acting as a financial intermediary between buyers and sellers. The algorithms that DEXs use are examples of smart contracts. The idea behind a DEX is disintermediation, which means removing intermediaries so peer-to-peer (P2P) trading can occur. Most DEXs do away with conventional exchange order books, where buyers and sellers are matched based on order prices and volume, in favor of liquidity pools.

Liquidity pools are peer-to-peer marketplaces enabling anyone to supply two tokens into a pool, providing liquidity to match buyers and sellers facilitated by an Automated Market Maker (AMM) algorithm.

Amberdata helps you understand the composition of DEX liquidity pools. You’ll know who holds how much and at what percentage. You can view wallet-level data to see pool participation, earnings and losses (impermanent and realized). Backtest your liquidity mining programmatic strategies with historical DEX data to maximize returns.

Liquidity providers who deposit token pairs earn a percentage of the transaction fees charged to users of the pool. This is called liquidity mining. In exchange for providing assets to the pool, investors are given Liquidity Provider (LP) tokens. Their LP tokens generate a yield that is based on the investor’s share of the total pool liquidity. As long as the assets provided remain in the liquidity pool, the DEX may also reward liquidity providers with native governance tokens. These tokens give access to the DEX’s governance and can also be exchanged for rewards or other cryptocurrencies. This liquidity mining process is critical to the AMM model.

Similar to traditional asset classes there are DEXs that provide spot, derivatives (e.g., options, futures, and perpetual contracts), and margin trading. There are also several DeFi protocols that create synthetic assets that can be traded, including Synthetix and UMA.

With automated and permissionless trading facilitated by automated market makers (AMMs), decentralized exchanges (DEXs) are the key players in the DeFi ecosystem. Amberdata delivers real-time and historical reference data to meet your trading and compliance needs.

Borrowing/Lending

Aave is one of the most popular DeFi lending protocols in the crypto space. The platform lets users lend and borrow crypto tokens. As of May 2022, there was over $16 billion of liquidity locked in Aave.

DeFi lending protocols are leaders in the DeFi ecosystem and present an opportunity for lenders to provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually, no end date) or undercollateralized (one-block liquidity, aka flash loans) fashion. DeFi lending protocols offer many advantages over traditional lending. Loans are generally overcollateralized and algorithmically facilitated. Like a DEX, the transaction process is fully automated.

Similar to DEX liquidity pools, DeFi lending pools serve this automated process. DeFi lending is instantaneous and provides permissionless access, enabling loans to be made to anyone with the proper collateral.

With Amberdata, you can understand the different lending and borrowing rates and view each protocol and its composition (e.g., who is in the pool, their lending and borrowing positions and where the assets are leveraged and controlled).

In addition to lenders receiving interest, many DeFi lending protocols reward users with native tokens. Users earn a pro-rata share of tokens based on how much they borrow or lend. This provides an additional yield to users, rewarding active participation in the protocol.

DeFi arbitrage opportunities exist across DEXs, liquidity pools, and protocols. Amberdata provides the DeFi data that is critical to developing efficient arbitrage strategies.

Staking

As of April 2022, the total value of cryptocurrencies staked exceeded $280 billion.

A fundamental element of proof-of-stake (PoS) blockchains are validators. Validators are network participants who stake (or lock) a certain quantity of native coins to participate in verification of new blocks of data being added to the network. In exchange for participating in validation of new blocks, validators earn staking rewards. They have a vested interest in the blockchain and must perform their duties correctly or risk being “slashed” and losing part or all their staked coins. Staking offers crypto holders a way of putting their digital assets to work. As validators, they can earn passive income without needing to sell their tokens. This is referred to as direct staking. The most popular cryptocurrencies that can be staked are Solana (SOL), Ethereum (ETH), Terra (LUNA), and Cardano (ADA).

In the DeFi space there are more than 40 staking protocols over 20+ blockchains.

As of April 2022, the TVL of the 22 liquid staking protocols was nearly $23 billion.

One of the issues with direct staking is that the high balance requirements to become a validator are often beyond the means of many coin holders. For example, to become a validator on Ethereum requires staking 32 ETH. However, any digital asset holder can participate in the staking process by delegating their holdings to stake pool operators who do all the heavy lifting involved with validating transactions on the blockchain. There are even DeFi staking protocols like Lido and Socean that optimize delegation to maximize return and reduce staking risk.

With Amberdata, you can see the current yield on various proof-of-stake protocols and can easily determine which exchanges have better yields. When deciding when and where to stake, Amberdata provides the analytics you need to maximize staking yield.

Liquid staking protocols like Lido and Socean take the staking concept one step further by solving the issue of locking the staked asset. In these protocols, underlying invested assets remain locked while participants receive a token representing their ownership share of the stake pool. These tokens are liquid and can be used in other DeFi protocols for utility and additional returns without sacrificing the staking rewards earned by the underlying staked asset.

Lido is the top liquid staking protocol. According to Lido’s stats on April 26, 2022, they had $19,232,873,531 staked among 101,481 stakers. $10.6 billion is from Ethereum.

Insurance

As a new segment of the digital asset class, DeFi poses considerable risks. Bugs in dApps, design issues with smart contracts, poor data from oracles, and software exploits are some of them. New DeFi insurance dApps are now available to provide coverage for these risks.

DeFi insurance providers allow you to pay a set amount or percentage of assets to get coverage to protect against loss of assets on a particular protocol for a specific time period. The amount paid is based on the provider, duration and coverage type. It’s important to understand exactly what events are covered when obtaining DeFi insurance, as is the case with traditional insurance policies. DeFi insurance coverage is available for protocol attacks/hacks, stablecoin price crashes and even smart contract bugs.

Nexus Mutual is one of the leading DeFi insurers, providing coverage for smart contract failures and exchange hacks. Some of the other popular DeFi insurance providers include Solace and Unslashed. Even blockchain infrastructure provider Blockdaemon recently announced staking slashing insurance as a new offering.

While DeFi provides great opportunities, it comes with its share of risks. In 2021, over $12B was lost as a result of DeFi hacks.

Asset Management

The asset management sector of DeFi aims to provide services such as yield optimization and portfolio management in a non-custodial, decentralized fashion, with no need for active managers. DeFi asset management’s focus is to make investing cheaper, safer and more accessible. They often connect to a wide variety of DeFi protocols making for a seamless experience for investing across them, with automated collateralization, rebalancing and liquidations. DeFi users can manage their investments across the entire protocol ecosystem with easy-to-use management dashboards.

Yearn Finance is one of the emerging asset management leaders, providing automated strategies implemented with smart contracts with the intent to find the most favorable yields while minimizing risk. Yearn creates pools of assets across lending protocols like Aave, Compound and Fulcrum, continuously looking for the best yields and rebalancing. This approach effectively automates yield farming strategy for the user. Yearn’s most complex feature is Vaults. These automated smart contracts combine strategies to maximize returns. As an analogy, think of Vaults like actively managed mutual funds. Investing in Vaults is simple as the interface allows users to see the historical return for each strategy and invest with popular stablecoins like USDC and DAI.

Yearn Finance was launched in 2020 and as of November 2021 had already amassed $6 billion in assets under management.

Other popular asset management protocols include Enzyme Finance and Set Protocol.

Who Is In?

Amberdata provides the data that secures 23 billion in TVL across the leading DeFi protocols and DEXs.

According to blockchain research firm Blockdata, institutional DeFi could grow into a $1 trillion space by 2025. Financial institutions have not overlooked the growth of DeFi. In fact, the best known logos in financial services are among the largest investors in the space.

It seems likely that what we now call decentralized finance may become simply, finance. Despite it still being early days for institutional DeFi, institutions have already started to dominate, at least based on transaction volume. Large institutional transactions (defined as those above $10 million) became the biggest segment of DeFi transactions by volume beginning in Q4 of 2020 and grew to over 60% of transaction volume by Q2 of 2021.

Innovative institutions that begin building and marketing DeFi products soon, either on their own or partnering with existing projects, could capture a significant piece of this space as it grows, generating tremendous value and returns for their investors. At the same time, those who don’t enter DeFi soon risk being left behind, if not becoming obsolete.

Regardless of how you plan on performing due diligence on a potential DeFi partner, you will need blockchain and DeFi protocol data. Before looking into potential DeFi partnerships, institutions should have a digital asset data partner like Amberdata in their corner.

DeFi could help financial institutions eliminate costly, proprietary infrastructure and bring efficiency to traditional functions such as data management, trading, lending and borrowing. DeFi apps are already leveraging smart contracts to replace many of thesefunctions. With these money legos already in place, financial institutions can gain a competitive advantage. They can bring new offerings to market faster and far more cost-effectively than in traditional finance. In fact, it’s not only that they can do it but that they must to survive long term.

On March 09, 2022, President Biden issued the “Executive Order on Ensuring Responsible Development of Digital Assets” which outlined the U.S. government’s much anticipated regulatory priorities for digital assets and directed federal agencies to begin work on recommendations and frameworks. While not specifically DeFi-related, the notion of a regulatory framework for digital assets is bringing confidence to both institutional and retail investors. For institutions in particular, the practical implications are that much of the existing regulatory uncertainty will soon be cleared up, reducing risk and simplifying compliance, particularly with AML/KYC laws. Once regulations are published, it will be possible to create long-term digital asset strategies that are not currently viable due to regulatory uncertainty. Regulatory certainty should also increase demand for digital assets among more conservative investors who are avoiding the asset class due to their lower risk tolerance.

This executive order makes it clear that the U.S. government recognizes digital assets as part of the future of the financial system. Institutions that were hesitant to enter the DeFi space may now feel more comfortable moving forward.

Looking to Enter the Digital Assets?

If you're looking to enter the digital asset space, you need Amberdata.

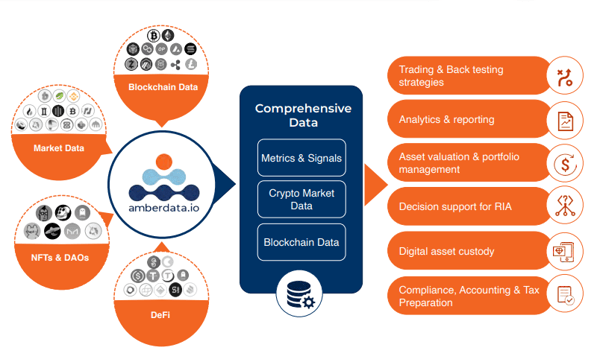

Our platform connects to all the blockchains and markets that matter today, allowing a comprehensive view of crypto markets, blockchain networks, NFTs, DAOs, and DeFi. We provide real-time and historical transparency into markets and price discovery across spot, derivative and decentralized exchanges, as well as on-chain data from the most active cryptocurrency networks and protocols.

Our data solutions support all pre- and post-trade functions. We provide deep market data, down to Level 2 order books, facilitating backtesting of quant trading strategies. And our blockchain data provides transparency not seen with other asset classes, allowing you to track pending transactions and wallet balances over time across various blockchain networks, as well as market cap and total value locked. You can also create analytics dashboards with fundamental data to track network health and understand DeFi data like liquidity and lending rates. For fund accounting and administration, you’ll know what was in a wallet at any time and what it was worth in any currency. For institutions that want to do custody themselves rather than outsource it, we provide the on-chain data needed.

With Amberdata, you get a single integration point for market and on-chain data, eliminating the need to integrate offerings from multiple vendors and allowing you to accelerate time to market for your digital asset products. We’ve built our data sets with institutional use cases in mind, providing the easy to consume formats and reliability you receive with traditional asset classes.

Request a demo to find out how the Amberdata platform solves digital asset data challenges and enables institutions to enter the digital asset space quickly, easily, and reliably. info.amberdata.io/demo